Dhaka, June 13 (V7N) - Investigations are intensifying into alleged financial irregularities involving Beximco Group, IFIC Bank, and associated individuals, with Fakhrul Abedin Milon, former Head of CRM at IFIC Bank, at the center. Milon is accused of facilitating over Tk 500 billion in liabilities for Beximco, much of which has reportedly turned into classified loans. Allegations include violations of banking laws, exceeding lending ceilings, and systemic failures in corporate governance.

Two major fraud cases involve "Glowing Construction and Engineering Ltd." and "Serve Construction and Engineering Ltd.," both alleged to be fake companies. The Glowing Construction case reportedly embezzled Tk 678 crore, while the Serve Construction case misappropriated Tk 496 crore. Both schemes allegedly involved fraudulent loans approved without proper collateral or due diligence, implicating numerous IFIC Bank officials, including Milon, and highlighting institutional complicity.

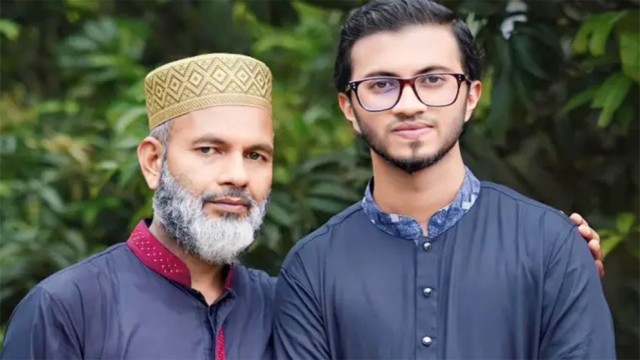

Milon is also implicated in the "IFIC Aamar Bond Scam," involving Sreepur Township, a company linked to Salman F Rahman and his son, Shayan F Rahman. Allegations include overvaluation of collateral, misleading promotions, and misuse of Tk 10 billion raised through bonds. A significant portion of the funds was reportedly funneled into companies owned by Salman F Rahman, raising concerns about conflicts of interest and ethical breaches.

As manager of IFIC Bank's Federation Branch, Milon is accused of approving loans to Anwar Cement Limited, which allegedly used the funds to repay prior debts, violating central bank regulations. This further underscores systemic weaknesses in IFIC Bank's internal controls and risk management practices.

Since August 2024, Milon and his wife have been accused of engaging in social media propaganda favoring Beximco Group and opposing Jamaat-e-Islami. These allegations, combined with the financial scandals, point to a pattern of misconduct and institutional failures, raising serious concerns about public trust in IFIC Bank and the broader banking sector.

END/FAM/RH/

Comment: