Dhaka, Oct 18 (V7N) — Bangladesh’s external sector has shown signs of steady recovery, with a foreign exchange surplus of $480 million recorded in the first two months (July–August) of the current fiscal year 2025–26 — more than double that of the same period last year.

According to the Bangladesh Bank, the improvement comes on the back of strong export growth and higher remittance inflows, contributing to a healthier current account position.

During this period, imports rose by about 10 percent, with goods worth $18.80 billion entering the country. Meanwhile, export earnings climbed 11 percent to reach $7.93 billion, resulting in a trade deficit of $2.96 billion, compared to $2.75 billion during the same period of the previous fiscal year.

In detail, imports of capital goods surged by 24.5 percent, while imports of intermediate goods increased by 8.2 percent, reflecting a gradual rebound in industrial and infrastructure activities.

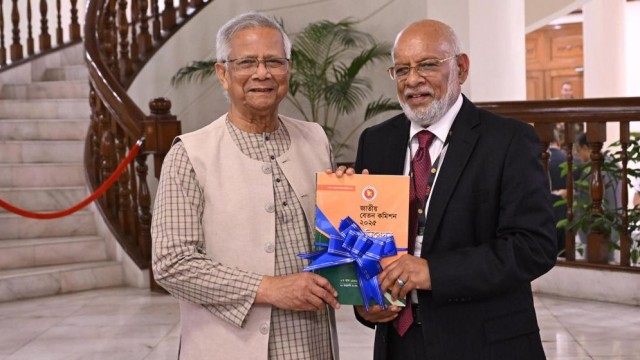

Economists and central bank officials attribute this improved outlook to tighter controls on money laundering and improved governance following the change of government. As a result, foreign exchange reserves have risen by $8 billion, now standing above $32 billion.

The combination of rising exports, growing remittance inflows, and increased investor confidence signals a positive trajectory for Bangladesh’s external sector in the coming quarters.

END/SMA/AJ

Comment: