Dhaka, May 17 (V7N) — Dr. Muhammad Yunus, Chief Advisor to the interim government, emphasized the need for the microcredit sector to evolve beyond the NGO model and be institutionalized as banks under a proper legal framework.

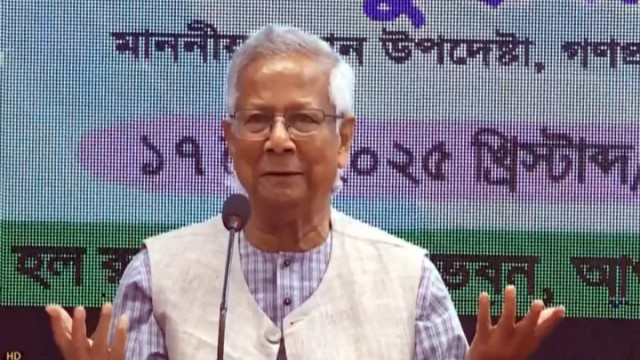

Speaking at the inauguration ceremony of the Microcredit Regulatory Authority (MRA) building in Agargaon on Saturday morning, Dr. Yunus stressed that a dedicated law must be enacted to establish microcredit banks.

“We have reached a stage in microcredit development that calls for a fresh approach,” said Dr. Yunus. “Microcredit should transition from NGOs to become banks. If microcredit institutions remain NGOs, they cannot fully adopt the banking model. A new law should create microcredit banks — social business banks focused solely on microfinance.”

Dr. Yunus explained the current limitations faced by microcredit institutions, such as only being allowed to take savings from members and not accepting public deposits. “Why should these institutions, which conduct good banking, be restricted like cooperatives? It’s time to enact the Micro Credit Bank Act to grant them full banking rights.”

He further said that microcredit banks should be licensed specifically for microfinance activities and operate as social commercial banks, highlighting their social mission.

“Microcredit’s founding idea is that people are entrepreneurs. Instead of seeking jobs, they should create jobs by becoming entrepreneurs. We provide the tools for this transformation,” Dr. Yunus said. “Any young man or woman can receive investment from a microcredit bank, eliminating the need to search for employment.”

He concluded that the government’s role is to create institutions, including banks, that empower youth to invest and start their own businesses.

The inauguration was also attended by Financial Advisor Dr. Salehuddin Ahmed, Bangladesh Bank Governor Dr. Ahsan H. Mansur, and MRA Executive Director Professor Helal Uddin Ahmed.

END/MSS/AJ

Comment: