Dhaka, Jan 10 (V7N) — Bangladesh Bank Governor Dr. Ahsan H. Mansur has said that a new law is being drafted to strengthen oversight of Islamic banks, noting that while Islamic banking has significant potential in Bangladesh, the sector requires restructuring to ensure depositor confidence and financial security.

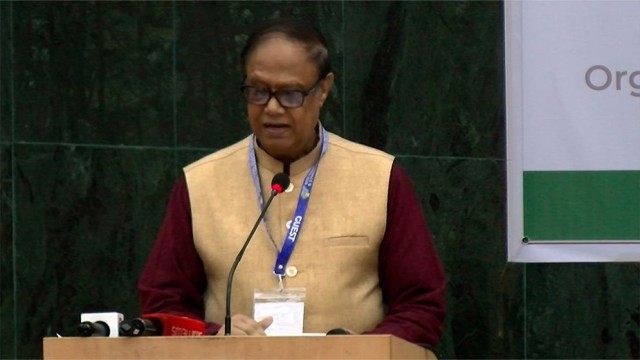

The governor made the remarks while speaking at an Islamic Finance Conference held at Dhaka University on Saturday morning.

Dr. Mansur said that ensuring the security of depositors’ funds is the central bank’s primary responsibility. He acknowledged that Bangladesh Bank had failed to fully meet this responsibility in the past but stressed that the current authorities are making continuous efforts to restore confidence in the banking system.

“Depositors’ trust in Islamic banks is gradually returning,” he said, adding that a large Islamic bank has recently been formed through the merger of five banks, which he believes will further help restore confidence among depositors of the merged institutions.

Highlighting structural challenges, the governor said that an Islamic bond market is essential for effective liquidity management, but admitted that no substantial progress has yet been made in this area.

He noted that the Sukuk bonds issued so far by private enterprises are small in scale and insufficient to develop a robust Islamic capital market. Referring to Beximco’s Sukuk bond, Dr. Mansur said it has damaged the market’s potential, as it was imposed rather than developed through proper market mechanisms.

The governor emphasized that regulatory reforms, improved governance, and market-based instruments are necessary to unlock the full potential of Islamic banking in Bangladesh.

END/SMA/AJ

Comment: