Dhaka, May 20 (V7N) — In a move aimed at paving the way for future negotiations to reduce additional tariffs imposed by the United States, the Bangladesh government is set to lower import duties on at least 100 items in the upcoming national budget for the fiscal year 2025–26.

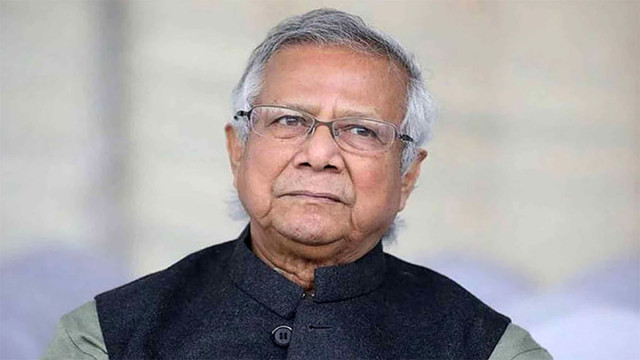

The decision received in-principle approval during a high-level meeting on Monday between the National Board of Revenue (NBR) and Chief Adviser Muhammad Yunus. The meeting took place at the Jamuna residence of the Chief Adviser.

Present at the meeting were Economic Adviser Saleh Uddin Ahmed, NBR Chairman Abdur Rahman Khan, and senior officials from the Income Tax, VAT, and Customs policy divisions, including members, first secretaries, and second secretaries.

Strategic Move to Facilitate US Trade Talks

The initiative to lower import tariffs is part of Bangladesh’s broader commitment to easing trade barriers and aligning with global trade practices, particularly in response to the additional tariffs imposed by the United States in recent years. By reducing duties on a wide range of goods, the government hopes to strengthen its negotiating position and foster a more favorable environment for bilateral trade discussions.

A senior official familiar with the matter stated, "The tariff reduction will serve as a goodwill gesture and a confidence-building measure, demonstrating our readiness to engage in constructive dialogue with international partners."

Key Decisions on Income Tax Policy

In addition to tariff adjustments, the meeting also outlined major policy decisions regarding income tax:

-

Tax-Free Income Threshold: The government plans to increase the tax-free income limit, providing relief to lower and middle-income individuals.

-

Minimum Tax for Individual Taxpayers: A minimum tax of BDT 5,000 will be introduced for individual taxpayers, aimed at broadening the tax net and ensuring fair contribution from all eligible citizens.

-

Top Tax Bracket: The maximum income tax rate will be raised to 30%, reflecting a more progressive taxation structure intended to enhance revenue without disproportionately burdening the lower-income population.

Budget Aims to Balance Growth and Fiscal Responsibility

Officials emphasized that the upcoming budget will strike a balance between revenue generation and economic growth. The proposed measures are expected to not only boost investor confidence but also promote transparency and compliance within the taxation framework.

The full details of the budget for FY2025–26 will be unveiled in June, with parliamentary approval anticipated ahead of the new fiscal year beginning on July 1.

END/SMA/AJ/

Comment: